While deploying drone operators to collect Inspection Class 3D Data has failed to provide compelling near and long-term value, the emergence of Engineering Class 3D Data promises to deliver new insights that go beyond ensuring a fair valuation and providing a stronger negotiating position.

ARTICLE

Mergers & Acquisitions: When drone data provides a competitive advantage

MERGERS & ACQUISITIONS: WHEN DRONE DATA PROVIDES A COMPETITIVE ADVANTAGE

Written by

Josh Meler

Chief Marketing Officer

While deploying drone operators to collect Inspection Class 3D Data has failed to provide compelling near and long-term value, the emergence of Engineering Class 3D Data promises to deliver new insights that go beyond ensuring a fair valuation and providing a stronger negotiating position.

Over the past few years, we’ve seen a surge in M&A activity among telecom companies worldwide. And as new construction opportunities disappear, leaders must increasingly turn to acquisitions to deliver strong returns and expand their footprint.

Ideally, decision makers would have up-to-date information about sites and calculations of their revenue potential. However, in actuality, most deals rely on outdated and untrustworthy tower data, involving minimal information about the assets that are bought or sold. Historically, transactions include a list of tower sites with basic information about locations and equipment, and a handful of random tower visits to verify information. This means leaders are largely blind to the actual state of tower sites and their capacity.

To gain a competitive advantage in the modern telecom marketplace, companies need more and better information about tower sites. Currently, on both sides of the transaction, very little is known about tower sites, equipment and available capacity. This means buyers could be overpaying and sellers could be leaving money on the table. To make a prudent and quantifiable decision, they key is to getting a complete and up-to-date view of each site.

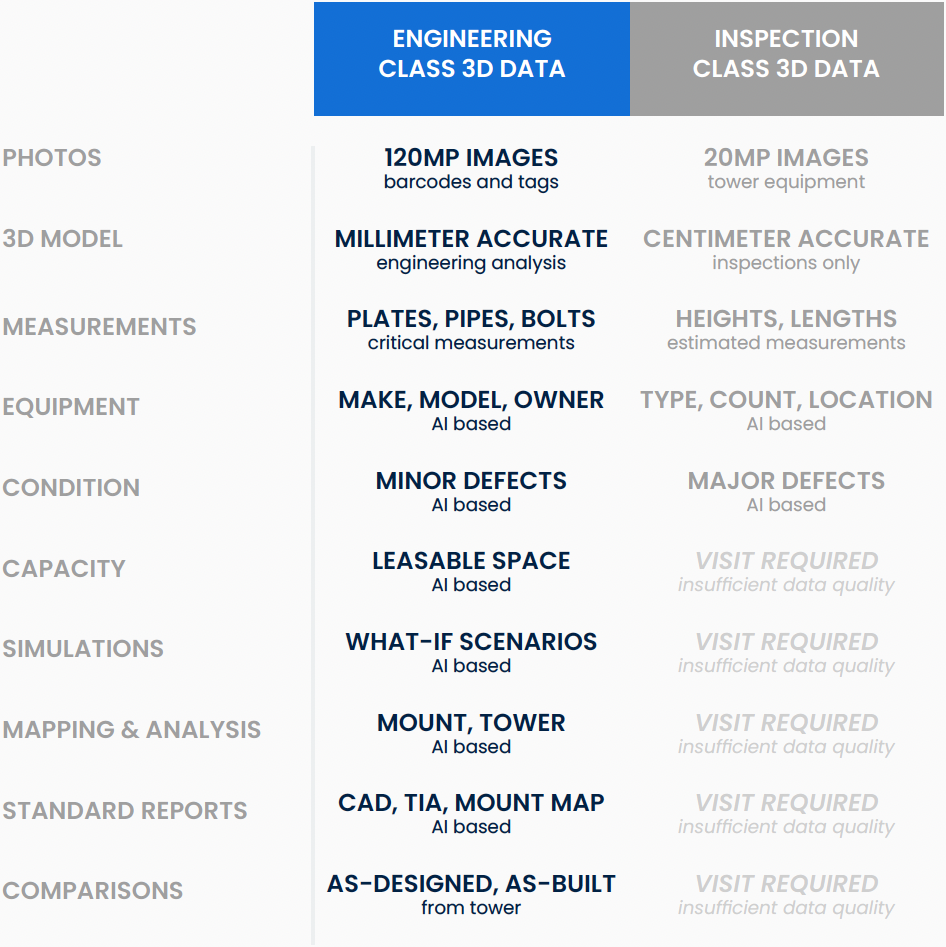

The Failed Drone Experiment

Towercos have experimented with drone technologies that theoretically can provide rapid and accurate information about hundreds of tower sites in the due diligence stages of a transaction. However, while the data most drones can provide offers a rough estimate of equipment location and type, solutions lack the data fidelity to eliminate the need for a technician visit (before and after a transaction). Most drone analytics solutions have been built around Inspection Class 3D Data, and lack the level of detail and coverage needed to recognize equipment owners, perform critical measurements on pipe and plate thicknesses, or automate mount and tower analysis. Unfortunately, this class of data doesn’t provide useful data on precise inventory or tower utilization.

Moreover, because Inspection Class 3D Data doesn’t provide engineering-grade accuracy, these solutions rely on accurate and complete legacy information to cross-validate against. And as we established earlier, legacy data is the underlying challenge for many M&A activities. In all, the economics of mobilizing drone operators to scan tower sites, and then requiring duplicative technician visits to the same sites (either as a part of due diligence or following an M&A transaction to plan structural modifications) provide minimal return on investment or time savings.

A New Playing Field

Fortunately, recent drone sensor innovations have ushered in a new class of 3d data1. Drones-based methods can now provide Engineering Class 3D Data on tower structures. This unlocks industry prerequisite millimeter accuracy and 99% surface coverage. Analytics companies like Bentley Systems have begun to invest in AI software that leverages this fidelity of 3d data to automate new forms of analytics that calculate attributes including structural capacity and simulate modifications2.

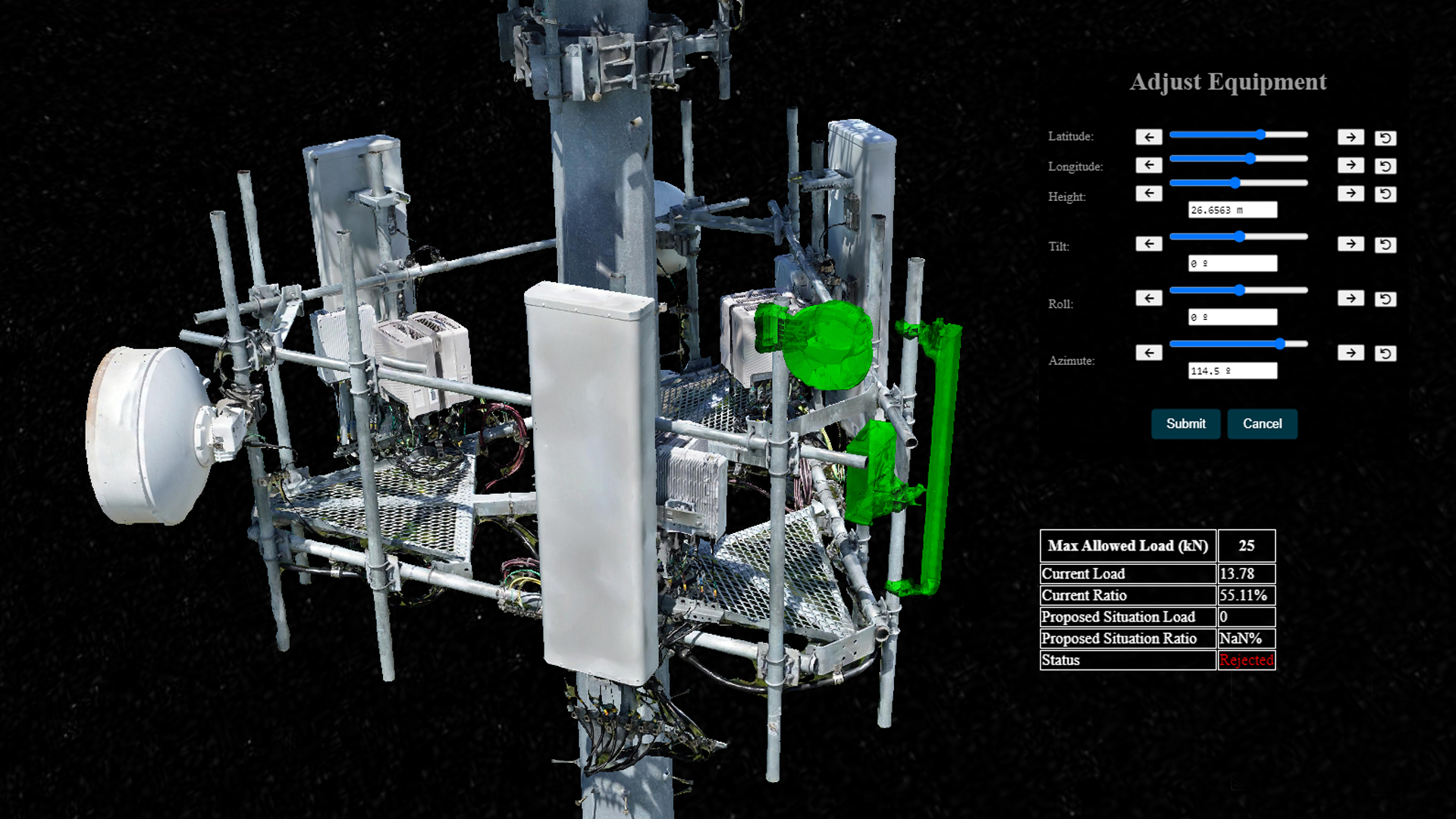

Figure 1: OpenTower iQ Digital Twin Platform. Equipment Modification Simulation.

For M&A activities, this new class of drone data will enable companies to obtain a complete and up-to-date view of each tower site, often resulting in better data than the seller has access to. Engineering Class data provides a window into onsite tower conditions for technicians and engineers, precise enough for millimeter measurements and complete enough for structural assessments. Towercos who obtain this class of data as a basis for M&A decisions will be able to capitalize on revenue opportunities and identify contract escalators. Decision makers who have this data at their disposal will be able to quantify the value of new assets, and better maximize site utilization.

For sellers, Millimeter Class 3D Data helps leaders assess the true value of their assets, and strengthen their negotiating position. For buyers, Millimeter Class 3D Data helps leaders identify potential risks and quantify potential upside opportunities.

Benefits beyond M&A

More importantly, Engineering Class 3D Data provides significant value after the M&A transaction is completed. Typically, after a deal is finalized, it takes months before a site is operationalized and leasing activities can begin. This is because towercos need to inspect sites and gather precise measurements to plan for tower modifications. However, when Millimeter Class 3D Data is gathered during the M&A due diligence process, towercos have a fully functional digital twin that can automate those same measurements and simulate modifications in near real-time. This enables teams to evaluate sites simultaneously and begin leasing activities immediately. This has the potential to accelerate rent by months.

Digital twins also offer value over the full tower lifecycle, and can be referenced for future equipment changes or modifications. Using AI-based tools, Digital Twins can augment and replace traditional labor-intensive activities, such as tower climbs, issue recognition, change detection, report generation, engineering analysis, and as-built comparisons.

In Summary

As the pattern of M&A activities continue to increase in both size and scope, and as larger and heavier modern equipment takes a toll on older structures, leaders are pressured to make more educated investment and divestment decisions.

While the economics of deploying drone operators to collect Inspection Class 3D Data has failed to provide compelling value, the emergence of Engineering Class 3D Data promises to deliver new insights that ensure a fair valuation, provide a strong negotiating position, and accelerate rent on new assets. And towercos that choose to generate Digital Twins as a part of the M&A process will benefit from intelligence tools and analytics that offer significant value over the tower’s full lifecycle.

1. The Visual Intelligence MACS-3D Sensor is the industry’s first and only drone sensor system designed to collect Engineering Class 3D Data on tower structures.

2. Bentley Systems has partnered with Visual Intelligence to launch the OpenTower iQ Digital Twin Platform, performing AI-based analytics and reporting using Engineering Class 3D Data.